Lender Checklist: What You Need for a Mortgage

- W-2 forms — or business tax return forms if you’re self-employed — for the last two or three years for every person signing the loan.

- Copies of at least one pay stub for each person signing the loan.

- Account numbers of all your credit cards and the amounts for any outstanding balances.

- Copies of two to four months of bank or credit union statements for both checking and savings accounts.

- Lender, loan number, and amount owed on other installment loans, such as student loans and car loans.

- Addresses where you’ve lived for the last five to seven years, with names of landlords if appropriate.

- Copies of brokerage account statements for two to four months, as well as a list of any other major assets of value, such as a boat, RV, or stocks or bonds not held in a brokerage account.

- Copies of your most recent 401(k) or other retirement account statement.

- Documentation to verify additional income, such as child support or a pension.

- Copies of personal tax forms for the last two to three years.

“Copyright NATIONAL ASSOCIATION OF REALTORS®. Reprinted with permission.”

How Big of a Mortgage Can I Afford?

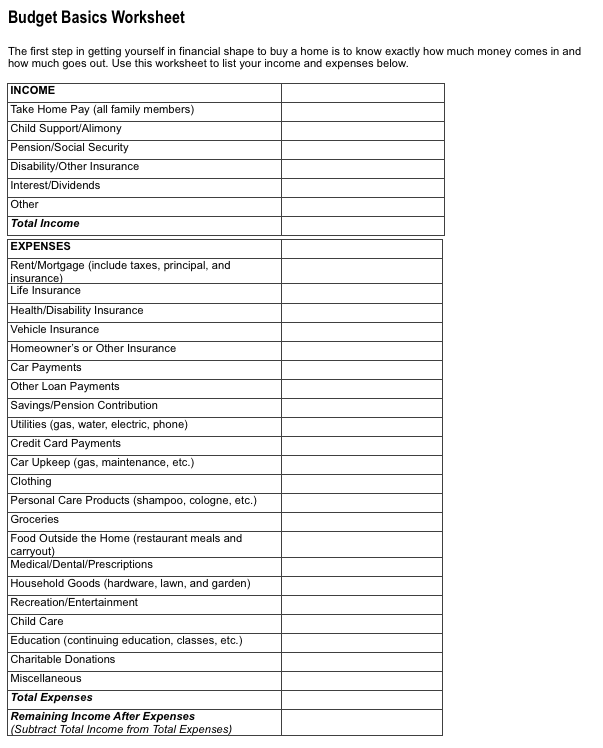

Not only does owning a home give you a haven for yourself and your family, it also makes great financial sense because of the tax benefits — which you can’t take advantage of when paying rent.

Not only does owning a home give you a haven for yourself and your family, it also makes great financial sense because of the tax benefits — which you can’t take advantage of when paying rent.

The following calculation assumes a 28 percent income tax bracket. If your bracket is higher, your savings will be, too. Based on your current rent, use this calculation to figure out how much mortgage you can afford.

Rent: _________________________

Multiplier: x 1.32

Mortgage payment: _________________________

Because of tax deductions, you can make a mortgage payment — including taxes and insurance — that is approximately one-third larger than your current rent payment and end up with the same amount of income.

Loan Types to Consider

Brush up on these mortgage basics to help you determine the loan that will best suit your needs.

Mortgage terms. Mortgages are generally available at 15-, 20-, or 30-year terms. In general, the longer the term, the lower the monthly payment. However, you pay more interest overall if you borrow for a longer term.

Fixed or adjustable interest rates. A fixed rate allows you to lock in a low rate as long as you hold the mortgage and, in general, is usually a good choice if interest rates are low. An adjustable-rate mortgage is designed so that your loan’s interest rate will rise as market interest rates increase. ARMs usually offer a lower rate in the first years of the mortgage. ARMs also usually have a limit as to how much the interest rate can be increased and how frequently they can be raised. These types of mortgages are a good choice when fixed interest rates are high or when you expect your income to grow significantly in the coming years.

Balloon mortgages. These mortgages offer very low interest rates for a short period of time — often three to seven years. Payments usually cover only the interest so the principal owed is not reduced. However, this type of loan may be a good choice if you think you will sell your home in a few years.

Government-backed loans. These loans are sponsored by agencies such as the Federal Housing Administration (www.fha.gov) or the Department of Veterans Affairs (www.va.gov) and offer special terms, including lower down payments or reduced interest rates to qualified buyers.

Slight variations in interest rates, loan amounts, and terms can significantly affect your monthly payment. For help in determining how much your monthly payment will be for various loan amounts, use Fannie Mae’s online mortgage calculators.

“Copyright NATIONAL ASSOCIATION OF REALTORS®. Reprinted with permission.”

10 Questions to Ask Your Lender

- What are the most popular mortgages you offer? Why are they so popular?

- Which type of mortgage plan do you think would be best for me? Why?

- Are your rates, terms, fees, and closing costs negotiable?

- Will I have to buy private mortgage insurance? If so, how much will it cost, and how long will it be required? (NOTE: Private mortgage insurance is usually required if your down payment is less than 20 percent. However, most lenders will let you discontinue PMI when you’ve acquired a certain amount of equity by paying down the loan.)

- Who will service the loan — your bank or another company?

- What escrow requirements do you have?

- How long will this loan be in a lock-in period (in other words, the time that the quoted interest rate will be honored)? Will I be able to obtain a lower rate if it drops during this period?

- How long will the loan approval process take?

- How long will it take to close the loan?

- Are there any charges or penalties for prepaying the loan?

Field Guide to Credit Scoring

Credit scoring has become a serious issue in the lending community and it can affect your ability to obtain or refinance your next mortgage. Credit scoring systems can gauge a mortgage applicant’s credit rating and assign an interest rate and risk value based upon information provided in the loan application. Credit scoring offers several advantages. It provides quick recommendations while taking human judgment out of the equation. Credit scoring also is extremely efficient and, usually, inexpensive. This updated field guide includes articles and books relating to credit scoring. (D. McCormick, Operations Analyst)

7 Common Credit Report Mistakes

Learn how to improve consumers’ credit by spotting damaging errors on a credit report.

Consumers see the ads in the newspaper and read the signs nailed to telephone poles: “Credit problems? We erase bad debt.” It sounds so easy. Just call the phone number and pay a fee, and your credit woes will disappear.

The reality is that bad credit does not vanish by paying someone to remove it. Are there legitimate credit repair organizations out there? Sure, and they can help remove inaccurate information from credit reports. But even they can’t get rid of correct information, however damaging it may be.

When it comes to outright mistakes on their credit report, though, it’s imperative that consumers have them fixed — whether they hire an agency or do it themselves.

The first step in fixing credit report errors is to identify what’s wrong. Consumers have to obtain a copy of their credit report (everyone is entitled to one free report per year from each of the three credit bureaus: Experian, Equifax, and TransUnion) and review it for accuracy. Look for:

- Late payments. There should be no late payments over seven years old on the report. This is important, as approximately 35 percent of a credit score is based on timely payments.

- Collections. The report shouldn’t show any collections or charge-offs more than seven years old. It’s a good idea for consumers to save copies of their credit report for seven years so they have proof of when an item was added.

- Payment records. All paid-in-full installment loans and all collections that have been paid in full or settled for less than the amount due should show a zero balance. Sometimes collections are not updated after they’ve been paid or settled.

- Mysterious accounts. Consumers should be able to recognize all accounts listed on the report. Incorrect accounts do sometimes appear, either by mistaken identity or by identity theft. Consumers should contact the creditor immediately to compare their name and Social Security number with the one shown for the incorrect amount. In the case of an incorrect collection, consumers may have to request a “validation of debt,” or what is sometimes called a “media packet,” which provides details on the account holder. If the account is a case of identity theft, the consumer should request a fraud affidavit from the creditor. It’s also a smart idea to file a police report.

- Original dates. Length of credit history is 15 percent of a credit score, so consumers should be sure the original dates they opened their accounts are accurate. Original account dates could be reported inaccurately if a credit card company is acquired or merged, or if a credit card is reported lost or stolen.

- Available credit. Credit limits on the credit report should match up with credit card statements. It’s best to keep balances under 50 percent of the available limit; less than 30 percent is even better. Debt accounts for 30 percent of your score.

- Types of accounts. Sometimes accounts are not categorized correctly. A home equity line of credit should be listed as a second mortgage, not just a line of credit. If the account type is not reflected properly, consumers should contact the creditor.

- Reason codes. Consumers should read what the credit bureau has to say about why their score is what it is. These so-called “reason codes” appear in the credit report to explain what factors played into the credit score and what actions can be taken to improve the score over time. One caveat: If a consumer already has a good credit score, ignore the reason codes, as making changes could actually result in a lower score.

One last word of advice for consumers: Think twice before closing that credit card, which shrinks the available credit listed on your report and hurts the credit utilization ratio.

The key to good credit is being proactive in reviewing credit reports regularly. If consumers find their credit score is a respectable 680 or higher, removing minor dings may not be worth the effort. Otherwise, finding and eliminating errors is one way to get the high credit rating they deserve.

Rx for Consumers’ Credit

For a better rate and terms, buyers should take these five steps before they fill out a mortgage application.

Bad credit can ruin a deal.

Bad credit translates into financing rejections, prohibitively high loan rates, and failed deals. That’s why real estate professionals need to educate themselves about the credit system and show prospective buyers the value of repairing their credit, if necessary, in order to qualify for a mortgage.

Unfortunately for borrowers, most credit reports contain inaccurate information. A June 2004 study performed by the U.S. Public Interest Research Group, a consumer advocacy group, showed that 23 percent of consumers had mistakes on their credit reports serious enough to result in the denial of credit. All told, an amazing 79 percent of consumers had some mistake.

Fortunately, consumers’ rights are protected under the Fair Credit Reporting Act. The FCRA gives consumers the ability to correct, update, amend, and take action regarding the contents of a credit report. It also guarantees consumers accuracy, fairness, and privacy in their credit reports.

The Act protects consumers only if they take action, however. Credit bureaus report the information they are given by creditors; they don’t verify it. If an error occurs, the burden of discovering and correcting it rests on the consumer. Here’s what your customers should do before they apply for a mortgage to make sure their credit reports are accurate:

- Find out what’s in their file. Every U.S. consumer is now entitled to one free credit report annually from each of the three credit bureaus: Experian, Equifax, and TransUnion. The easiest (and free) way to get a copy of your report is to go to the government-mandated Web site www.annualcreditreport.com. Also note that if consumers are denied a mortgage or other credit, the lender must tell them whether information in their credit report played a role in the denial.

- Dispute inaccurate information. If your customer determines that something is incorrect on a credit report, the next step is to correct the inaccuracy. If consumers obtained their credit reports at www.annualcreditreport.com, they can dispute errors online. Another option is to write a letter to all three credit bureaus detailing the dispute. (Some states require one agency to notify the other two, but why risk it?) The letter should include documentation such as a cancelled check showing payment, a discharge from bankruptcy, or the like. Remember, banks typically use the middle of the three credit scores when assessing a loan application. If one report showing a high score is correct but the other two are not, the buyers may still be denied credit or forced into less-favorable terms.

- Dispute inaccurate items at the source. Consumers will also want to contact the credit card company or other source of the inaccurate information. For example, if a payment is credited incorrectly, it may be easier to resolve the error by contacting the credit company than a collection agency.

- Excise outdated information. By law, credit bureaus are supposed to remove information pertaining to the credit score — such as a late payment or collection — that is more than seven years old. Neutral information such as employment history does not have to be removed since it does not affect credit scores. Consumers should ensure that the credit bureau removes older information since it can still negatively affect a credit score.

- Protect credit identity. The Fair Credit Reporting Act makes it a federal crime to knowingly and willfully obtain a person’s credit report without consent or under false pretenses. If consumers feel that their credit has been compromised, they can request that a credit agency put a “fraud alert” on their account. Consumers can take an even more aggressive step to protect their credit from identity thieves by paying credit bureaus to put a security freeze on their credit. Consumers can temporarily lift the freeze when they apply for a mortgage.

Helping your customers ensure that their credit is intact before they begin the homebuying process will make it easier for them — and you.

Stop the Bleeding

Tips for prospects with truly bad credit:

- Get your spending under control.

- For one or two late payments, ask the lender to re-age the loan.

- Give it time. Even after a foreclosure, a credit score can be repaired within three years. A foreclosure should be removed from the record after seven years and a Chapter 7 bankruptcy after 10 years.

Specialty Mortgages: Risks and Rewards

In high-priced housing markets, it can be difficult to afford a home. That’s why a growing number of home buyers are forgoing traditional fixed-rate mortgages and standard adjustable-rate mortgages and instead opting for a specialty mortgage that lets them “stretch” their income so they can qualify for a larger loan.

But before you choose one of these mortgages, make sure you understand the risks and how they work.

Specialty mortgages often begin with a low introductory interest rate or payment plan — a “teaser”— but the monthly mortgage payments are likely to increase a lot in the future. Some are “low documentation” mortgages that come with easier standards for qualifying, but also higher interest rates or higher fees. Some lenders will loan you 100 percent or more of the home’s value, but these mortgages can present a big financial risk if the value of the house drops.

Specialty Mortgages Can:

Pose a greater risk that you won’t be able to afford the mortgage payment in the future, compared to fixed rate mortgages and traditional adjustable rate mortgages.

Have monthly payments that increase by as much as 50 percent or more when the introductory period ends.

Cause your loan balance (the amount you still owe) to get larger each month instead of smaller.

Common Types of Specialty Mortgages:

Interest-Only Mortgages: Your monthly mortgage payment only covers the interest you owe on the loan for the first 5 to 10 years of the loan, and you pay nothing to reduce the total amount you borrowed (this is called the “principal”). After the interest-only period, you start paying higher monthly payments that cover both the interest and principal that must be repaid over the remaining term of the loan.

Negative Amortization Mortgages: Your monthly payment is less than the amount of interest you owe on the loan. The unpaid interest gets added to the loan’s principal amount, causing the total amount you owe to increase each month instead of getting smaller.

Option Payment ARM Mortgages: You have the option to make different types of monthly payments with this mortgage. For example, you may make a minimum payment that is less than the amount needed to cover the interest and increases the total amount of your loan; an interest-only payment, or payments calculated to pay off the loan over either 30 years or 15 years.

40-Year Mortgages: You pay off your loan over 40 years, instead of the usual 30 years. While this reduces your monthly payment and helps you qualify to buy a home, you pay off the balance of your loan much more slowly and end up paying much more interest.

Questions to Consider Before Choosing a Specialty Mortgage:

How much can my monthly payments increase and how soon can these increases happen?

Do I expect my income to increase or do I expect to move before my payments go up?

Will I be able to afford the mortgage when the payments increase?

Am I paying down my loan balance each month, or is it staying the same or even increasing?

Will I have to pay a penalty if I refinance my mortgage or sell my house?

What is my goal in buying this property? Am I considering a riskier mortgage to buy a more expensive house than I can realistically afford?

Be sure you work with a REALTOR® and lender who can discuss different options and address your questions and concerns!

5 Property Tax Questions You Need to Ask

- What is the assessed value of the property? Note that assessed value is generally less than market value. Ask to see a recent copy of the seller’s tax bill to help you determine this information.

- How often are properties reassessed, and when was the last reassessment done? In general, taxes jump most significantly when a property is reassessed.

- Will the sale of the property trigger a tax increase? The assessed value of the property may increase based on the amount you pay for the property. And in some areas, such as California, taxes may be frozen until resale.

- Is the amount of taxes paid comparable to other properties in the area? If not, it might be possible to appeal the tax assessment and lower the rate.

- Does the current tax bill reflect any special exemptions that I might not qualify for? For example, many tax districts offer reductions to those 65 or over.

Infographic shows homes that have been purchased by age group.

“Copyright NATIONAL ASSOCIATION OF REALTORS®. Reprinted with permission.”